When Counties Team Up, Tax Dollars Go Further

Research reveals interconnected service networks deliver cost savings and lower tax burdens for residents.

In Nebraska, cooperation isn’t just a virtue. It’s a fiscal strategy.

Research conducted by American University scholar Tingli Qu found when local governments pool resources — anything from emergency response to education and public safety — they spend less on service delivery while collecting fewer tax dollars along the way.

But there’s also a welcome twist.

“When counties collaborate, taxpayer dollars stretch further,” Qu begins. ”But because of Nebraska’s rules, cooperation also gives extra property tax authority. This means service costs stay down, while governments still have the fiscal tools to respond [by raising additional revenue] in a crisis.”

Nebraska’s system allows local governments to raise property taxes to fund shared projects. That means counties can save money during good years by spending smarter, while also staying ready for unexpected emergencies.

The Science of Sharing Services

Oftentimes, scholars simply count the number of agreements and draw conclusions from there. But Qu went further, asking a deeper question: “Does where you sit in the collaboration network matter?”

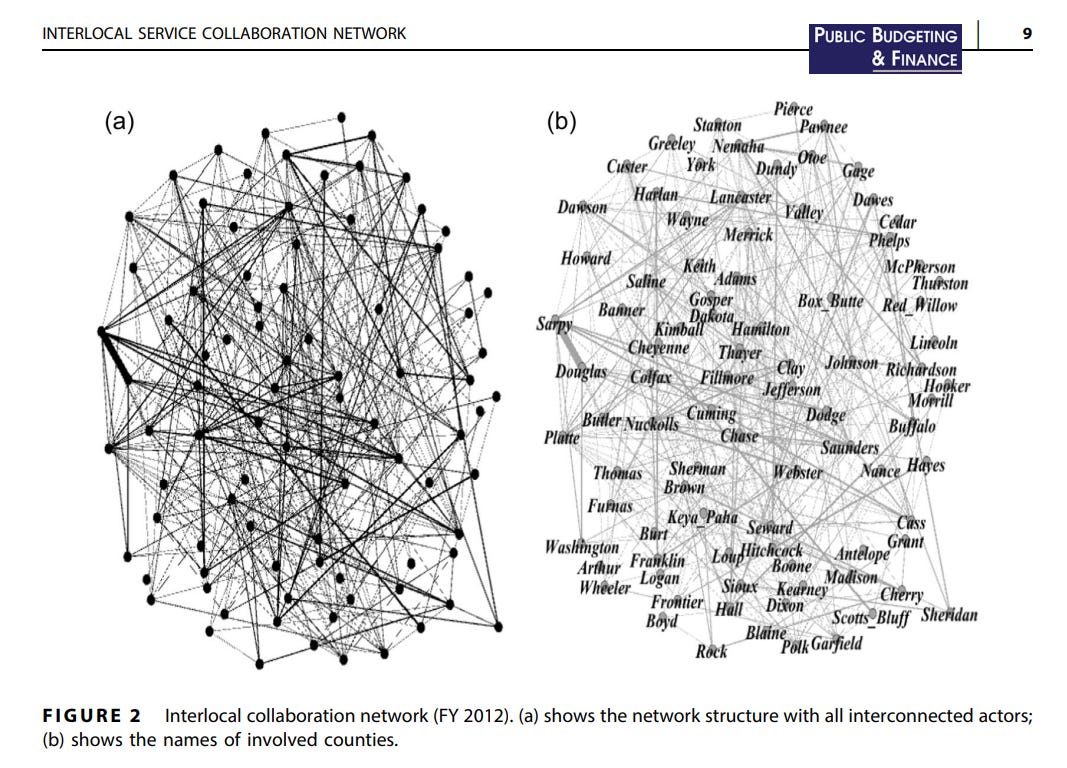

To find out, she analyzed five years of data (2012 - 2017) from every county in Nebraska, mapping who was working with whom, how centrally a county fell within an ILA, and measuring “density” by tallying the number of counties participating in the same agreement.

Her analysis was robust, but in plain terms, it turns out the answer is “yes.”

When counties enter service agreements with one another, they save money.

When multiple counties enter the same service agreement, the network gets denser, and they save even more money.

If counties enter disparate agreements, with a “central” entity playing intermediary between disconnected parties, the central player benefits the most.

Where Do the Cost Savings Come From?

If you’ve studied economics, this will sound familiar — centralizing service delivery leads to cost savings through economies of scale and reduced transaction costs.

Public policy professor Gang Chen, a public finance scholar not involved in the study, likens the logic to a small town sharing with neighbors.

“Rather than maintaining a fleet of vehicles, local governments can pool emergency response resources. The shared approach not only enhances disaster preparedness but also reduces the fiscal burden of maintaining redundant equipment and personnel.”

The analogy goes beyond just emergency response. Governments can consolidate pension or health insurance plans, school districts, police forces, waste management, and any number of other services.

The Nebraska Twist

The state’s fiscal framework adds an intriguing wrinkle. Since 1999, they’ve capped local property tax rates, but it also allows a small additional property tax levy for counties if the funds support ILAs.

That incentive is a second explanation Qu presents for her findings:

“This result differed from my expectations, but county governments, especially those with limited fiscal resources, actively seek to join ILAs because they can get access to additional property taxes.”

The Bottom Line: How Much Money Can We Save, Exactly?

Correlation isn’t causation, and Nebraska’s experience may not extend everywhere. But if we can, in fact, extrapolate from Qu’s data, there are significant savings on the table for both taxpayers and local governments.

Across Nebraska, counties in the middle 95% of her sample varied by +/- 6.8% in per capita revenue, and +/- 7% per capita spending, depending on how centrally positioned they were within an ILA. Similarly, those same counties varied by +/-3.5% per capita revenues and +/- 4.5% per capita spending, depending on their network’s density.

Taken together, that translates roughly to a maximum 10-20% spread between the highest and lowest bounds of her data, suggesting a county’s fiscal health depends not only on how much they spend, but also on how well they cooperate with their neighbors.

Qu’s research appeared in the November 2024 issue of Public Budgeting and Finance.

Our stories may be republished online or in print under Creative Commons license CC BY-NC-ND 4.0. We ask that you edit only for style or to shorten, provide proper attribution and link to our website. AP and Getty images may not be republished.