The Debt Problem Is Worse Than You Think

America’s $162.7 Trillion Problem

Recent research has revealed that the total federal indebtedness in the US is $162.7 trillion after accounting for the burden of current balances on future generations. This exceeds current estimates of federal debt, which is estimated at over $36.2 trillion and has attracted concern from policymakers.

The findings highlight the urgency of addressing the long-term consequences of unchecked spending and raise crucial questions about policymaking horizons.

US federal debt has grown consistently since the abandonment of the Budget Enforcement Act of 1990 in 2002, which put constraints on deficit-increasing measures. The issue is only likely to increase over time, as the high interest rate environment and slower-growing, tax-paying, working-age population make it more difficult to pay down debt.

Yet since commonly accepted debt estimates understate the true scope of the problem, researchers Jagadeesh Gokhale and Kent Smetters set out to find a more precise number.

Jagadeesh Gokhale, Director of Special Projects at the Penn Wharton Budget Model and an expert in U.S. fiscal policy, explains of his research: “This study brings together expertise accumulated over two decades on data sources, analytical methods, and budget policy frameworks. The motivating factor is to discover and summarize the implications of current budget allocations — that are specified in hundreds of billions of dollars across many federal programs — for the pocketbooks of people across socio-economic classes, those who are alive today, and future generations.”

The $162.7 trillion figure represents 6.6% of the present discounted value of GDP, and would change the economic landscape for future generations, with higher taxes and fewer state benefits.

Researcher Sita Nataraj Slavov, a professor of public policy at George Mason University (who was not involved in the study), said of the findings: “Economists have been warning for a long time that the federal government’s finances are on an unsustainable path. The government has made spending commitments that far exceed revenue, and the usual metrics — such as the current debt or short-term deficit projections — don’t capture this.”

Understanding Fiscal and Generational Imbalance

Policymakers primarily focus on explicit debt (the debt burden held in the present moment). This fails to consider how future debt will be repaid, which is a salient question as the deficit becomes excessive.

Adding implicit obligations offers a fuller measure of federal indebtedness, and therefore a more holistic view of the government’s financial situation. In their study, the researchers called this fiscal imbalance (FI).

As Sita explains: “The current debt only reflects what the government has already borrowed and is contractually obligated to repay. However, the government has made future spending promises that far exceed future revenue. That’s not reflected in the current debt, but it matters because some change will need to be made to bring that into balance.”

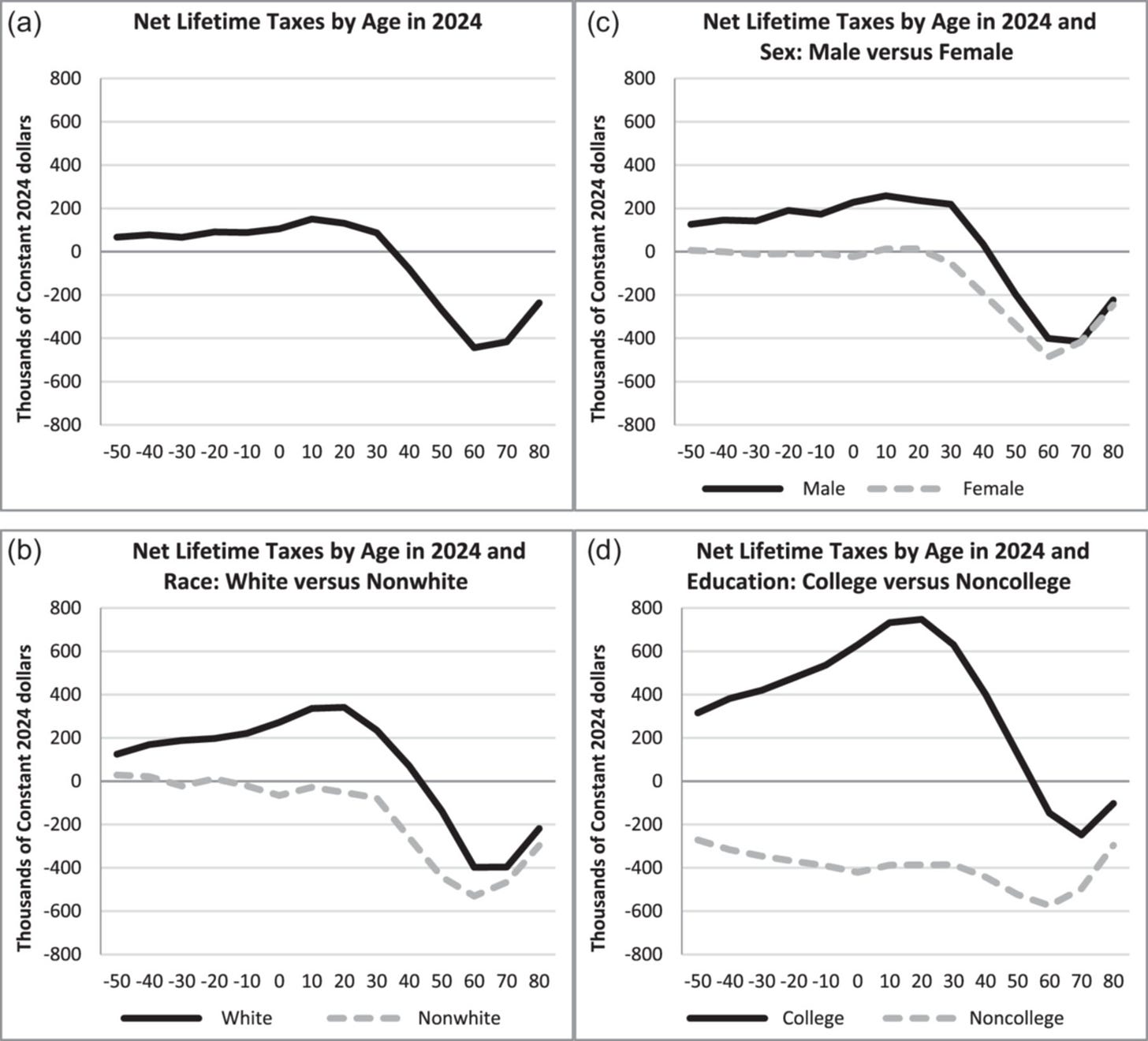

The paper also calculated generational imbalance (GI), which measures the imbalance between the federal taxes paid and the transfers received from social insurance programs by current and future generations.

It found that past and current generations are set to receive $62.7 trillion more than they will pay to fund Old-Age, Survivors, and Disability Insurance (OASDHI) programs. Meanwhile, maintaining the current OASDHI policy for those alive today throughout their lifetime will effectively levy significant taxes on future generations.

It’s an approach that most would agree is unsustainable and inherently unfair due to the burden placed on future generations, calling for the need to rethink fiscal policy.

Solutions For The Debt Problem

The new findings outline the current problems of the US government and its increasing debt, coloring fiscal issues in a new light.

Yet the solutions required speak to general principles of fiscal responsibility. Essentially, restoring fiscal balance requires some combination of tax increases and reductions in transfers or federal purchases.

The paper identified three main options:

Proportionate increases in all government receipts and reductions in all government expenditures. This would boost lifetime net tax profiles but reduced protections for those alive today and future generations.

Increases only in federal taxes. This would disproportionately affect those who pay higher net taxes.

Reductions only to all federal expenditures. This would disproportionately affect those who receive the largest net transfers.

There is a trade-off between harming those who most need a social security net and penalizing those who are most productive.

Jagadeesh explains: “The principles to follow are to achieve reasonable equity across current and future generations, provide a reasonable social safety net, and promote economic growth by maintaining low net tax burdens on households. A first step would involve distributing the adjustment burden for reducing the existing fiscal imbalance across as many individuals and generations as possible.”

A major reason that the government hasn’t placed enough emphasis on fiscal responsibility so far may be down to its short-term bias.

The Congressional Budget Office publishes budget projections for the next ten years, along with Social Security and Medicare actuaries. Since the reality of fiscal consequences go beyond this decade-long period, the current system results in a low chance of Congress adopting fiscal adjustments to address the entirety of its implicit federal obligations.

There’s also the fact that the hard fiscal changes needed tend to be inherently unpopular among voters.

Sita says: “Politically, it’s a difficult issue because restoring fiscal sustainability will require either cutting large, popular programs like Medicare and Social Security or raising taxes on the broader public, not just those at the top. These are hard choices, but something needs to be done.”

Sketching A Change In Thinking

While the figures identified in the research might suggest a bleak financial future for our children and grandchildren, Jagadeesh holds some hope that a better understanding of the current situation could change attitudes.

He says: “Federal tax and spending policies that emerge from the preferences of today’s voters and policymakers devote insufficient attention to their effects on future generations, presumably because the relevant information is not easily available. The hope is that revealing those effects may temper political incentives to adopt policies that could cause a vicious downward economic spiral.”

While the problem is rooted in economics, the path to a more sustainable future may well depend on a fundamental shift in public and political mindsets rather than solely on changing fiscal policies.

The research appeared in issue 45(1) of Public Budgeting and Finance.

Our stories may be republished online or in print under Creative Commons license CC BY-NC-ND 4.0. We ask that you edit only for style or to shorten, provide proper attribution and link to our website. AP and Getty images may not be republished.