Can Fiscal Rules in the EU Help America’s Federal Debt Problem?

Recent Research Says American Policy Makers Looking To Reduce Budget Deficits Might Want To Look Across The Pond

US government debt has increased considerably over the last 40 years — the debt-to-GDP ratio surpassed 100% in 2013, and it currently sits at 123%. For policymakers looking for reforms that might constrain this growth, there’s a lack of clear guidelines about how to approach these efforts.

However, recent research has started to turn to the European Union, where the countries have a variety of different rules designed to curtail government debt. The findings could provide potential guidance for the US as it faces a growing deficit. The authors of the study, Sungho Park and Sewon Kim (scholars at University of Alabama and Indiana University, respectively), found that expenditure rules were the most effective strategy, while balanced budget rules had minimal impact. Furthermore, fiscal rules are most effective at controlling debt when they’re more stringent, based on a stronger statutory basis, and are monitored by an independent body.

Understanding America’s Debt

Most predictions of US federal debt suggest it will continue to grow. This will likely mean a rising portion of future revenue is funneled into interest payments, reducing the government's ability to respond to future economic shocks or address social issues. The role of the US dollar as a world reserve currency and the power of economic growth have prevented the country’s debt sparking an economic crisis. Yet there’s no guarantee this can continue forever.

“The debt is projected to continue growing steadily due to structural factors such as an aging population, rising mandatory spending on programs like Medicare and Social Security, persistent defense expenditures, and ballooning interest payments” says Kim.

However, she is also keen to point out that there’s no universally agreed “magic number” for how much debt a country can take on, and the US hasn’t necessarily crossed a red line.

Besides, there is a tradeoff between maintaining a balanced budget and achieving desirable social outcomes. Jürgen von Hagen, Director of the Center for European Integration Studies and Professor of Economics at the University of Bonn, points out: “It is important to protect public investment from being slaughtered on the altar of expenditure rules. Germany is a prime example: 40 years of allegedly fiscal discipline under conservative governments have resulted in a state of near collapse of public infrastructure and education.”

Policymakers cannot consider debt in a vacuum, although understanding how to tackle it is a necessary starting point.

Turning to Europe for Answers

Given the complexity of decisions related to debt management, taking an evidence-based approach is crucial. While there is limited data on the impact of various fiscal rules within the US, EU countries are the ideal environment to study.

The region has focused on the sustainability of public finances since the early 1990s, and European countries have experimented with various strategies. Plus, since the EU is made up of multiple countries that have each taken distinct approaches, which allows for comparisons.

Kim says: “Some countries have constitutional rules with automatic correction mechanisms; others rely on political commitments or advisory bodies. Such variation offers powerful insights into the institutional ingredients that help fiscal rules succeed—and provides a basis for thinking about how similar mechanisms might be adapted to the U.S. context.”

While the EU and the US are different in many ways, they share enough similarities for the results from Europe to be broadly applicable. “EU member states share many institutional and economic similarities with the U.S.” says Kim. “They operate under structured, democratic decision-making systems with competitive party politics, much like the American federal system. From a fiscal perspective, both the EU and U.S. governments shoulder primary responsibility for large-scale social spending programs, and in turn, carry the weight of rising public debt.”

The Power of Expenditure Rules

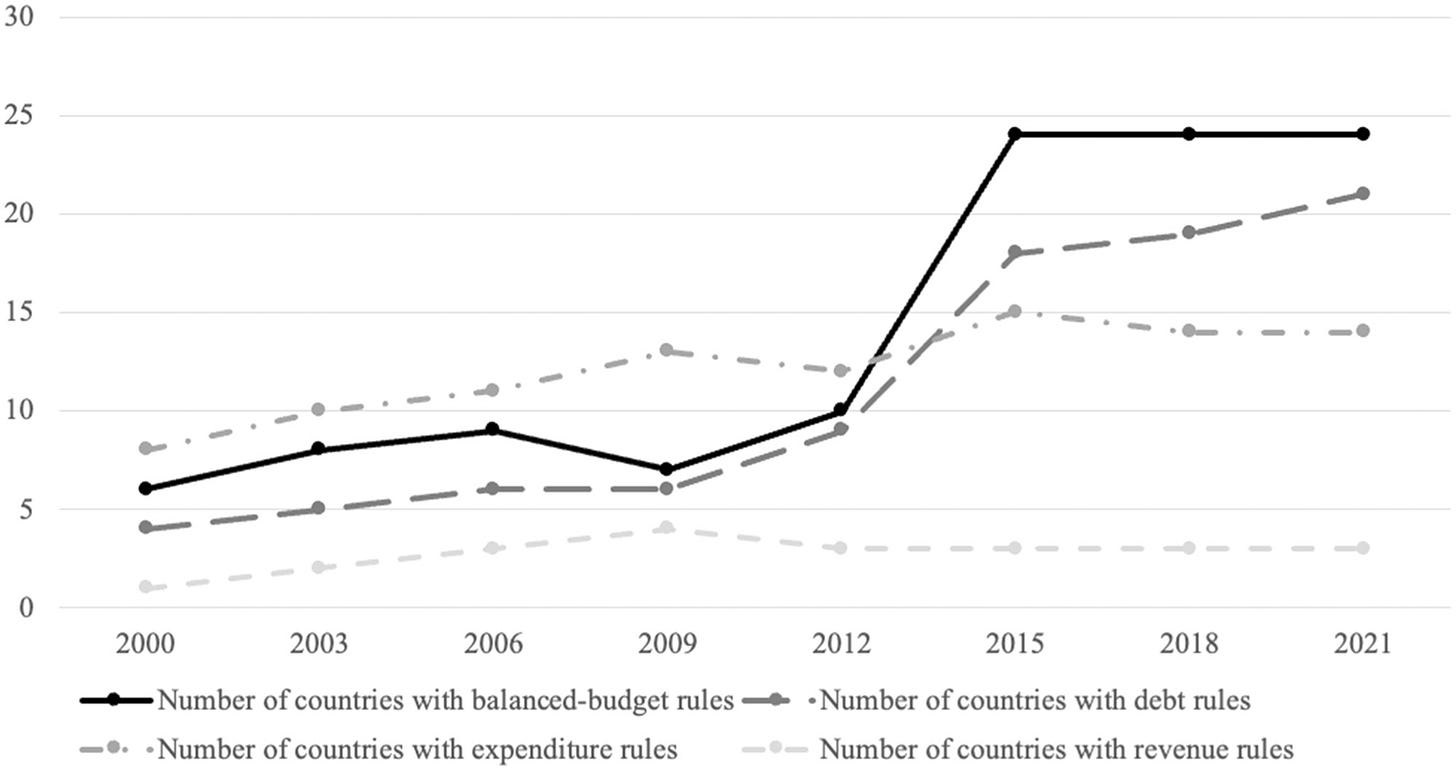

Studying EU countries between 2000 and 2021, the research looked at four types of fiscal rules:

Balanced budget rules (constraining the size of the deficit)

Debt rules (placing explicit limits on public debt)

Expenditure rules (limiting spending)

Revenue rules (putting a cap on revenues)

The key finding is that a single unit increase in the stringency index of expenditure rules led to a 0.9% decrease in the debt ratio, with greater stringency leading to even more impressive debt reductions.

This suggests that adopting and implementing expenditure rules may be the most effective approach the government can take. However, successful implementation would likely involve more than just setting a number to reduce spending.

Complementary mechanisms like independent monitoring authorities and real-time monitoring were also found to reduce central government debt (by 4.4% and 7.8% respectively). Jürgen von Hagen points out: “Monitoring is of key importance for the effectiveness of fiscal rules. Simple numerical rules invite accounting gimmicks to get around them. It takes human judgment to discover such efforts at evasion. This, in turn, requires sufficient political clout of the monitoring body in the public debate about fiscal policy. EU law now requires all member states to have fiscal policy watchdogs. The German one is a joke - noone even knows about its existence. The Portuguese one - of which I was vice chair and the chairwoman was a very well-known public figure - was quite effective in the years when she was there.”

Meanwhile, the research found no significance for fiscal rules. The authors speculate that this is due to their complexity, or the lack of clarity surrounding them. Achieving a balanced budget is a more ambiguous target than simply reducing spending, and governments may face political or economic pressure to bypass the rules.

The Viability of Effective Execution

While it’s a useful first step to know which kinds of interventions are the most effective, the political feasibility must also be considered.

Kim holds out some hope that the US will tackle its debt issues in the future. “There is a growing and evolving concern about mounting federal debt both inside and outside government. In addition to our study, many others have raised similar concerns and proposed a variety of potential paths forward. Organizations such as think tanks and nonprofits have continued to focus on this issue and have developed several innovative solutions. With such meaningful ideas in circulation, it is reasonable to believe that progress will be made—and that the debt challenge can be addressed over time.”

Another important question is how the government can balance the need to address debt with securing socially desirable outcomes, which requires more than just choosing a number.

The research appeared in issue 45(1) of Public Budgeting and Finance.

Our stories may be republished online or in print under Creative Commons license CC BY-NC-ND 4.0. We ask that you edit only for style or to shorten, provide proper attribution and link to our website. AP and Getty images may not be republished.